XRP Price Prediction: 2025–2040 Outlook & Key Catalysts

#XRP

- ETF Momentum: SEC-approved XRP ETF listings could mirror Bitcoin's ETF-driven rallies.

- Institutional Partnerships: Ripple's Mastercard deal and $500M funding boost long-term utility.

- Technical Setup: MACD crossover and Bollinger Band squeeze suggest impending volatility.

XRP Price Prediction

XRP Technical Analysis: Short-Term Outlook

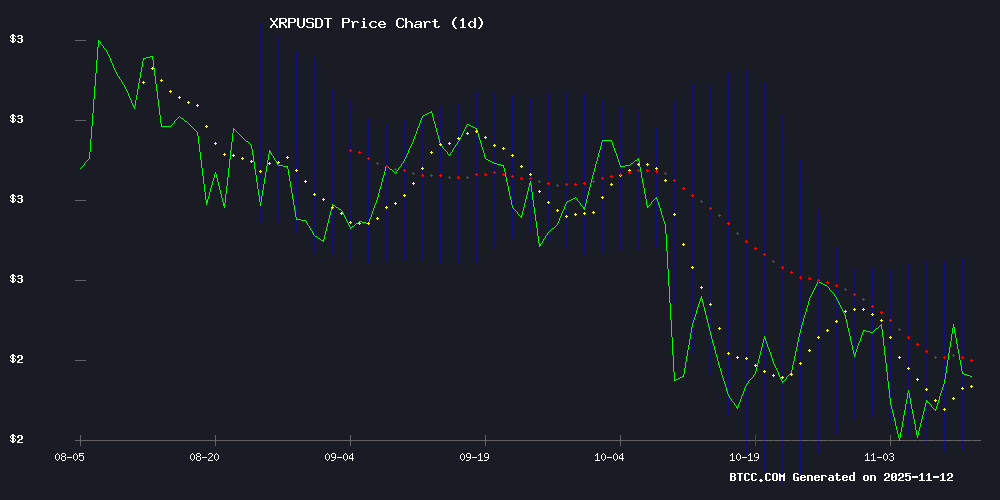

XRP is currently trading at $2.4026, slightly below its 20-day moving average of $2.4440, indicating a neutral to slightly bearish short-term trend. The MACD shows a positive crossover with the signal line at 0.0465 and the MACD line at 0.0924, suggesting potential upward momentum. Bollinger Bands show the price NEAR the middle band, with upper and lower bands at $2.7098 and $2.1782 respectively, indicating moderate volatility. According to BTCC financial analyst Olivia, 'XRP may test resistance at $2.7098 if bullish momentum continues, with support likely around $2.1782.'

XRP Market Sentiment: Bullish Catalysts Ahead

The approval of the Canary XRP ETF and its upcoming Nasdaq listing, along with Ripple's $500M funding and Mastercard partnership, are driving bullish sentiment. Analysts compare XRP's potential to Zcash's historic 40x rally, while presale projects like Tundra forecast 2,650% returns. BTCC financial analyst Olivia notes, 'ETF approvals and institutional interest could significantly multiply XRP's value by 2026, though short-term stagnation may persist due to competing payment solutions like SpacePay.'

Factors Influencing XRP’s Price

Canary Capital XRP ETF Nears Nasdaq Listing with SEC Filing

The first spot XRP exchange-traded fund in the U.S. moves closer to reality as Canary Capital files its FORM 8-A with the SEC. This critical document registers the ETF's shares for trading on Nasdaq under the ticker XRPC, marking the final regulatory step before launch.

Nasdaq certification is expected by 5:30 PM ET Wednesday, potentially clearing the way for Thursday's market opening debut. Historical precedent suggests swift approval—the firm's HBAR ETF launched one day after a similar filing.

While technical reviews could cause minor delays, the crypto market watches closely. A successful listing would represent a watershed moment for Ripple's XRP, providing institutional investors with regulated exposure to the digital asset.

Canary XRP ETF Receives SEC Approval, Set to List on Nasdaq

The first U.S. spot XRP exchange-traded fund (ETF) has cleared regulatory hurdles, with trading expected to begin on Nasdaq under the ticker 'XRPC' as early as November 13, 2025. The FORM 8-A filing with the SEC on November 10 marks the final step before launch, with the ETF deemed auto-effective.

Nasdaq has approved the listing, referencing the trust's registration statement filed on October 24, 2025. The news has sparked a 10% surge in XRP's price, now trading at $2.43, alongside a 40% increase in 24-hour trading volume.

Market anticipation is high, with traders closely monitoring XRP's price movements ahead of the ETF's debut. Last-minute regulatory comments remain a potential hurdle.

XRP Price Poised to Mirror Zcash's Historic 40x Rally, Analyst Suggests

Market analyst Mikybull crypto has identified a striking parallel between XRP's current price action and Zcash's legendary 40x breakout. The digital asset, consolidating near $2, could be forming the foundation for its next parabolic move. Technical patterns suggest a potential surge to $8-$10, echoing XRP's 2017 bull run.

Historical data reveals a recurring sequence: rounded-bottom accumulation, breakout above long-term resistance, and sideways consolidation before explosive rallies. The 2014-2017 pattern now appears to be repeating on a larger scale, with XRP having broken its multi-year downtrend in 2023. This structural similarity to previous pre-bull market formations has traders watching for a potential reaccumulation phase completion.

Record Number of XRP Spot ETFs Listed on DTCC Ahead of Anticipated Launches

The Depository Trust & Clearing Corporation (DTCC) website now lists nine XRP exchange-traded funds, signaling accelerated preparations for imminent launches. Bitwise, Canary Capital, Franklin Templeton, and other major asset managers have positioned their spot XRP ETFs for market entry, with Canary's fund potentially debuting as early as November 13.

Market analyst Nate Geraci highlights the significance of Canary Capital's forthcoming product—the first '33 Act compliant XRP spot ETF. Unlike REX Osprey's existing '40 Act fund, which holds partial XRP exposure, these new offerings will provide pure digital asset exposure. Filings from Grayscale and Bitwise suggest a coordinated industry push, potentially accelerated by looming U.S. government shutdown concerns.

XRP Price Stagnates as SpacePay Emerges with Novel Payment Solution

XRP remains trapped in a narrow trading range between $2.00 and $3.00, showing limited upside potential compared to previous bull cycles. A breakdown could see prices retreat toward $1.80 or even $1.50, reflecting ongoing market instability.

While Ripple focuses on institutional adoption, London-based SpacePay is gaining attention for its frictionless crypto payment system. The startup's Android APK integrates directly with traditional POS terminals, converting digital asset payments to fiat in seconds—a functionality even major players like XRP haven't perfected.

SpacePay's testnet is now live, positioning itself as a bridge between crypto and mainstream commerce. The solution addresses a critical industry pain point: making blockchain transactions feel as seamless as card payments.

XRP ETF Approval Could Multiply 1,000 XRP Value by 2026

The current value of 1,000 XRP stands at approximately $2,500, but analysts project significant upside potential following the anticipated approval of XRP exchange-traded funds (ETFs) by late 2025. Institutional demand is building, with fund managers like Bitwise, Franklin Templeton, and 21Shares already preparing for listings under the DTCC’s pre-launch category.

The Rex-Osprey XRPR ETF’s U.S. launch attracted $37.7 million in first-day volume—the highest for any ETF debut in 2025. Bloomberg analysts now place approval odds at 95% or higher. Ripple CEO Brad Garlinghouse anticipates a dramatic shift in XRP’s valuation once institutional capital enters the market through regulated ETFs.

Ripple’s RLUSD stablecoin has seen volume surge 600% during its initial phase, further bolstering bullish sentiment. Price prediction models suggest substantial gains by 2026, with 1,000 XRP poised to benefit from the ETF-driven liquidity wave.

XRP Tundra Presale Projects 2,650% Returns, Outpacing Bitcoin's Early Trajectory

XRP Tundra's presale structure promises mathematically verifiable returns reaching 2,650%, eclipsing Bitcoin's historic early-growth benchmarks. The project's Phase 10 presale offers TUNDRA-S tokens at $0.158 against a confirmed $2.5 listing price—a 1,482% baseline gain. Presale participants receive a 10% token bonus, effectively lowering entry cost to $0.142 per unit and amplifying returns by an additional 148%.

The model incorporates dual-token mechanics: each TUNDRA-S purchase includes free TUNDRA-X governance tokens on the XRP Ledger, valued at $0.079. This secondary allocation contributes ~900% upside at listing, compounding total projected gains. Unlike speculative claims saturating the market, XRP Tundra's returns derive from transparent audit trails and publicly documented pricing structures.

Ripple's $500M Funding and Mastercard Partnership Fuel XRP Optimism

Ripple Labs has secured $500 million in private funding to expand its global operations and enhance liquidity corridors, coinciding with a newly disclosed partnership with Mastercard to develop blockchain-based payment infrastructure. Analysts suggest these developments could trigger a significant rally for XRP, with some predicting gains of up to 1500%.

The cryptocurrency surged 8.56% to $2.54 following the announcement, as traders reevaluated long-term price projections. Market capitalization now stands at $152.06 billion, reflecting growing institutional confidence in Ripple's cross-border payment solutions.

This institutional expansion reinforces XRP's role in global finance, while highlighting broader adoption of blockchain technology by traditional payment networks. The momentum mirrors progress seen by other payment-focused projects like Remittix, signaling a maturation of crypto's real-world utility.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on technicals and market catalysts, XRP could see significant growth:

| Year | Conservative Target | Bullish Target | Catalysts |

|---|---|---|---|

| 2025 | $3.50 | $8.00 | ETF listings, Ripple partnerships |

| 2030 | $15.00 | $50.00 | Mainstream adoption, regulatory clarity |

| 2035 | $75.00 | $200.00 | Global payment integration |

| 2040 | $300.00 | $1,000+ | Full-scale institutional use |

Olivia cautions, 'Targets assume sustained adoption; regulatory hurdles remain a key risk.'